Market Update—Quarter Ending March 31, 2024

Posted April 4, 2024

- Strong Start to the Year for Stocks

A positive March for stocks caps off a solid first quarter.

- Mixed Quarter for Bonds

Bond returns were mixed due to rising rates in the quarter.

- Healthy Economic Growth

First-quarter economic reports show signs of healthy growth.

- Inflation and the Federal Reserve

Stubbornly high inflation caused the Fed to leave rates unchanged.

- Market Risks Worth Monitoring

Geopolitical, domestic, and unknown risks remain for markets.

- Despite the Risks, Outlook Remains Positive

The positive economic backdrop and improving fundamentals should support markets.

Strong Start to the Year for Stocks

It was a positive March for stocks, capping off a strong quarter to start the year. The S&P 500 gained 3.22 percent in March and an impressive 10.56 percent in the first quarter. The Dow Jones Industrial Average was up 2.21 percent during the month and 6.14 percent for the quarter. The Nasdaq Composite lagged its peers during the month but still had a strong start to the year, with a 1.85 percent gain in March and a 9.31 percent rise for the quarter. Improving fundamentals and a healthy economic backdrop helped drive the gains in the first quarter.

Per Bloomberg Intelligence, as of March 29 with all companies having reported earnings, the average earnings growth rate for the S&P 500 in the fourth quarter was 8.3 percent. This is notably higher than analyst estimates at the start of earning’s season for a more modest 1.2 percent increase. The better-than-expected earnings growth was widespread with 10 of the 11 sectors coming in above analyst estimates. Over the long run fundamentals drive market performance, so the impressive earnings growth was a good sign for investors.

Technical factors were also supportive during the month and quarter. All three major U.S. indices spent the entire quarter above their respective 200-day moving average. The 200-day moving average is a widely monitored technical indicator as sustained breaks above or below this level can signal shifting investor sentiment for an index. The continued technical support throughout the quarter was another welcome development for investors at the start of the year.

Results were similar, albeit a bit more muted, for international equities. The MSCI EAFE Index gained 3.29 percent in March and 5.78 percent for the quarter. The MSCI Emerging Markets Index rose 2.52 percent in March, but weakness to start the year held back quarterly results for emerging markets as the index only gained 2.44 percent for the quarter. Technical results were mixed for international stocks, as the MSCI EAFE Index spent the entire quarter above its 200-day moving average, while the MSCI Emerging Markets Index briefly fell below trend at the end of January before rebounding above its trendline for the rest of the quarter.

Mixed Quarter for Bonds

While equities had a largely positive start to the year, results were more mixed for fixed-income investors. Rising interest rates throughout the quarter weighed on bond prices, leading to a choppy ride for fixed-income markets. The 10-year U.S. Treasury Yield rose from 3.95 percent at the start of the year to 4.20 percent at the end of the quarter. The Bloomberg U.S. Aggregate Bond Index managed to notch a solid 0.92 percent gain in March, but the index was still down 0.78 percent for the quarter.

High-yield fixed income, which is typically less sensitive to changing interest rates, held up better during the month and quarter. The Bloomberg U.S. Corporate High Yield Index gained 1.18 percent in March and 1.47 percent for the quarter. High-yield credit spreads started the year at 3.54 percent and ended March at 3.12 percent. Falling credit spreads are a sign that investors became more willing to invest in the relatively riskier portions of the fixed income market during the quarter.

Healthy Economic Growth

The economic updates released throughout the quarter showed signs of healthy economic growth to start the year. Hiring accelerated at the end of 2023 and the momentum has carried into 2024, as more than 500,000 jobs were added between January and February. This strong job growth helped support continued personal income and spending growth, with personal spending rising in February at the fastest monthly pace in over a year.

Business spending also rebounded in February, following a Boeing-related slowdown in aircraft orders in January. Core durable goods orders, which strip out the impact of volatile transportation orders, also rebounded well in February after falling in January. This improvement was driven in part by improving manufacturer confidence and supportive service sector confidence to start the year. The improvement in manufacturer confidence was especially encouraging as the ISM Manufacturing Index rose into expansionary territory for the first time since 2022, in March.

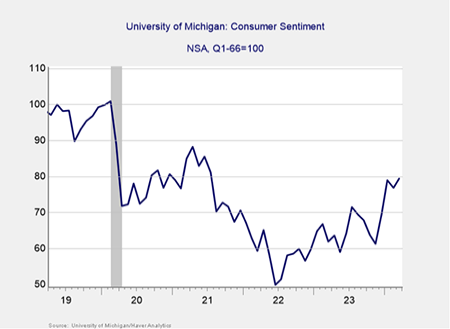

We also saw improving consumer sentiment during the quarter, which is a good sign for future consumer spending growth. As you can see in Figure 1 below, the University of Michigan Consumer Sentiment Index ended March at its highest level in over two years. Improved consumer views on current economic conditions as well as future expectations helped power the improvement in sentiment that we saw throughout the quarter.

The Takeaway

- Economic growth continued throughout the quarter, with hiring growth leading the way.

- Consumer and business spending came in strong in February.

- Improving consumer and manufacturing sentiment to start the year is a good sign for future spending growth.

Inflation and the Federal Reserve

While the strong economic growth to start the year was largely welcome for investors and economists, one downside of the better-than-expected growth was that it helped keep inflation stubbornly high during the quarter. We ended February with both headline and core inflation still well above the Fed’s 2 percent target. Additionally, it appears the progress we saw in late 2022 and throughout much of 2023 in getting inflation down has started to slow, with headline and core inflation only seeing modest improvements in the first quarter.

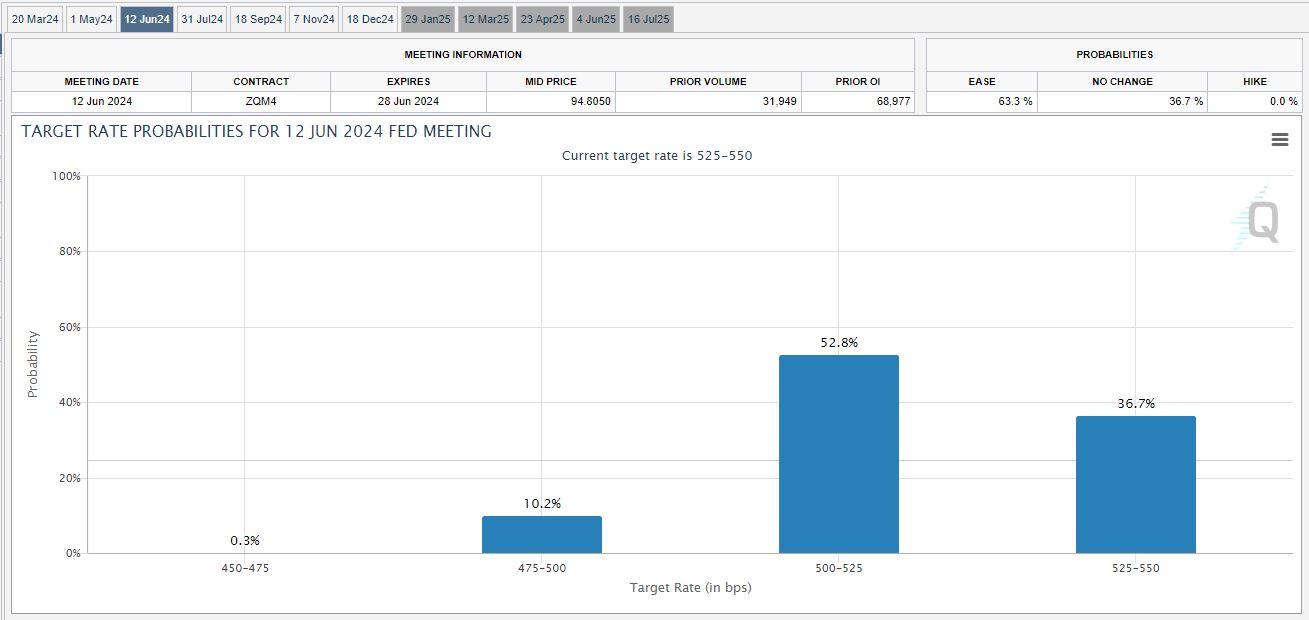

Given the still high levels of inflation, the Fed left rates unchanged at both their January and March meetings. Fed chair Jerome Powell reiterated the Central Bank’s commitment to getting inflation back down to 2 percent at the Fed’s March meeting and markets have adjusted their expectations for the Fed throughout the start of the year.

We entered the year with futures market pricing in roughly six interest rate cuts throughout the course of 2024, with markets calling for the first rate cut in March. Since then, we’ve seen job growth remain resilient while inflation has remained high, causing markets to pare back their expectations to be more in line with the three rate cuts the Fed expects by the end of the year. While these repriced expectations weighed on bonds to start the year, they should help keep volatility in check going forward provided we don’t see a further rise in inflation.

The Takeaway

- Inflation remains high, with headline and core price growth still above the Fed’s 2 percent target.

- The Fed left rates unchanged at its January and March meetings.

- Market expectations for rate cuts this year have dropped from six at the start of the year to three at the end of March, which is in line with current Fed guidance.

Market Risks Worth Monitoring

While a healthy economic backdrop and improving fundamentals helped propel markets to new highs in the first quarter, real risks remain for investors. The ongoing conflicts in Ukraine and the Middle East are one such risk. While the direct market impact from these clashes has remained muted, they have the potential to snarl already tangled global supply chains and drive further inflationary pressure, especially if hostilities escalate in these volatile regions.

Domestically the largest market risk is a potential reacceleration in inflation. While investors and markets have done well to lower their expectations for rate cuts this year, a sustained uptick in inflation could cause the Fed to wait until we see further improvement on the inflation front before cutting rates. The upcoming election in November is also a worth watching, as it will likely serve to drive uncertainty later in the year.

Other risks to monitor include a slowdown in China, relatively high valuations for U.S. stocks, and rising investor complacency. As always, the potential for unknown risks to negatively impact markets remains. As we saw last month with the destruction of the Francis Scott Key Bridge in Baltimore, external events can rear up at any time and place, with the potential to drive short-term uncertainty.

The Takeaway

- Risks remain for markets, including geopolitical risks in Ukraine and the Middle East.

- Domestic risks include a potential reacceleration in inflation as well as the elections at year-end.

- Unknown risks can also negatively impact markets and can’t be predicted.

Despite the Risks, Outlook Remains Positive

While it’s important to acknowledge the current market risks, overall we remain in a relatively good situation with a positive outlook for the months ahead.

The economic backdrop remains largely supportive, powered by a resilient job market that in turn helps drive improved consumer and business activity. U.S. companies have shown an impressive ability to grow earnings and analysts expect to see continued earnings growth ahead. Markets have now readjusted their expectations for the Fed throughout the rest of the year, lowering the potential for Fed-driven pullbacks. And finally we’ve seen encouraging signs that the economic and market momentum from the end of 2023 has carried over into 2024.

Ultimately, things are pretty good right now, but that is not always going to be the case. While continued economic growth and market appreciation remain the most likely path forward, we may face short-term setbacks along the way. Given the potential for short-term uncertainty, a well-diversified portfolio that aligns investor goals with timelines remains the best path forward for most, although if concerns remain you should speak to your advisor to discuss your financial plan.

Authored by Brad McMillan, CFA®, managing principal, chief investment officer, and Sam Millette, director, fixed income, at Commonwealth Financial Network®.

* Diversification does not assure a profit or protect against loss in declining markets, and diversification cannot guarantee that any objective or goal will be achieved

Disclosure: This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Please contact your financial professional for more information specific to your situation.

Certain sections of this commentary contain forward-looking statements based on our reasonable expectations, estimates, projections, and assumptions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. Past performance is not indicative of future results. Diversification does not assure a profit or protect against loss in declining markets. All indices are unmanaged and investors cannot invest directly into an index. The Dow Jones Industrial Average is a price-weighted average of 30 actively traded blue-chip stocks. The S&P 500 Index is a broad-based measurement of changes in stock market conditions based on the average performance of 500 widely held common stocks. The Nasdaq Composite Index measures the performance of all issues listed in the Nasdaq Stock Market, except for rights, warrants, units, and convertible debentures. The MSCI EAFE Index is a float-adjusted market capitalization index designed to measure developed market equity performance, excluding the U.S. and Canada. The MSCI Emerging Markets Index is a market capitalization-weighted index composed of companies representative of the market structure of 26 emerging market countries in Europe, Latin America, and the Pacific Basin. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners. The Bloomberg Aggregate Bond Index is an unmanaged market value-weighted index representing securities that are SEC-registered, taxable, and dollar-denominated. It covers the U.S. investment-grade fixed-rate bond market, with index components for a combination of the Bloomberg government and corporate securities, mortgage-backed pass-through securities, and asset-backed securities. The Bloomberg U.S. Corporate High Yield Index covers the USD-denominated, non-investment-grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below.

© 2024 Commonwealth Financial Network