Anything But Average

July 8, 2025

Stocks rallied sharply in June, with both the S&P500 and NASDAQ indices ending the month and quarter at new all-time highs. After an impressive May performance, the S&P500 gained 5.1% in June for the index’s first back-to-back monthly gains since September of last year. While tariffs and trade policy dominated headlines in early spring, this month it was Middle East turmoil which drove market direction. After the June 13th Israeli airstrike of critical Iranian nuclear facilities, which also took out several key military leaders and civilian scientists, President Trump was able to broker a deal between the two nations which ended the conflict after just 12 days of action. Equities rallied hard during the back half of the month to complete a powerful, V-shaped recovery from the intraday lows put it on April 8th.

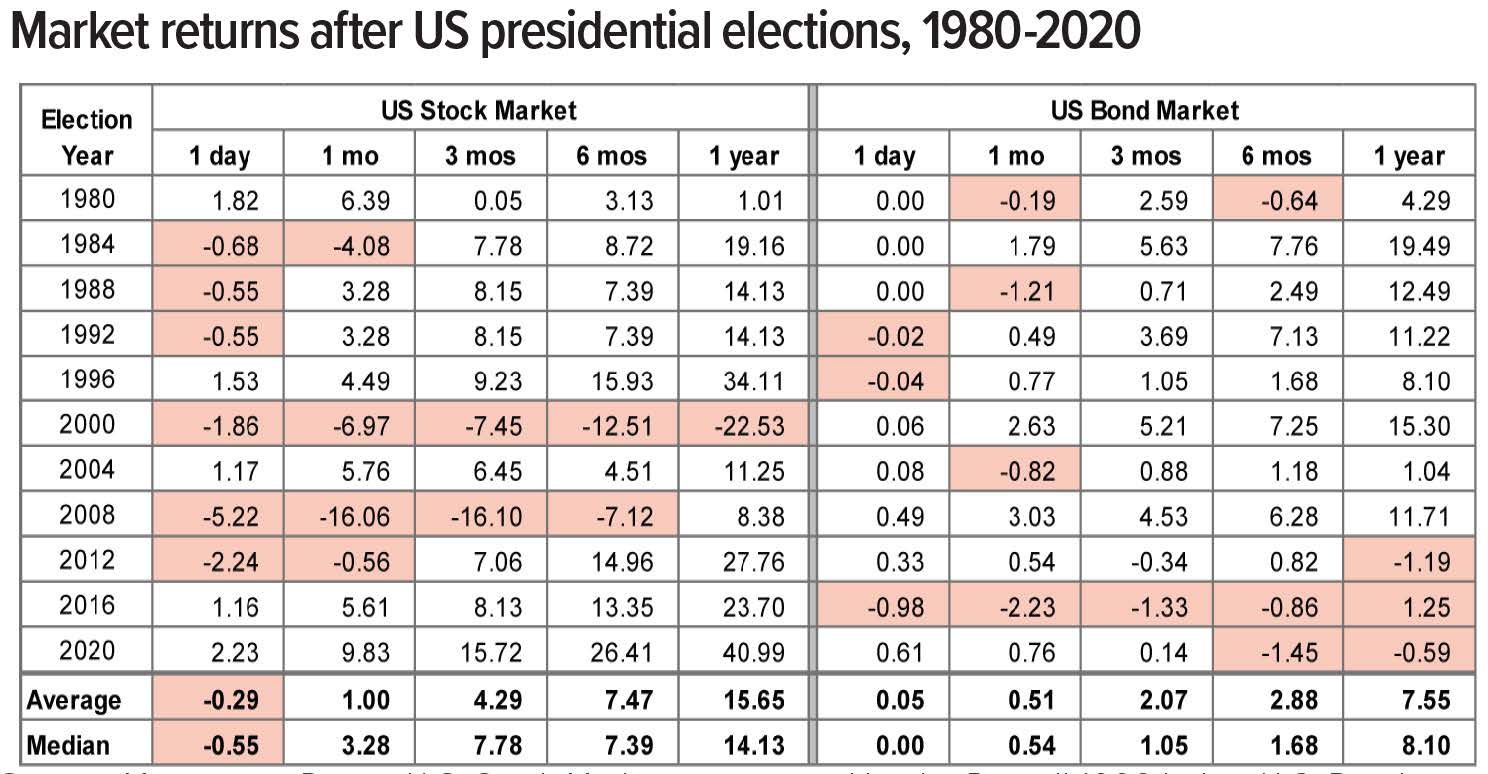

2025 has been an incredibly volatile year for equities, with both a 21% drawdown from February highs and a subsequent 26.4% rally (S&P500). But if one were to look at stocks through the first half of the year, one would note that 2025 appears to be a very average year. Stocks are up 5.5% and bonds are up just slightly less. But this “average” performance masks an extremely unstable period with outsized downside momentum. As investors, we have had to endure a lot of ambiguity and unsettling news this year. It is truly amazing that, despite all the challenges laid out above, both stocks and bonds are doing just fine as we enter the second half of the year. On ward and upward from here (we hope).

Declining bond yields, in addition to being a tailwind for the upward moves in stocks, bolstered fixed income returns in June. The US Aggregate Bond Index returned 1.15% during the month, corresponding with the 10Y Treasury yield falling by 17 basis points. This decline, largely a result of the previously mentioned unrest in the Middle East (and subsequent flight to safe-haven assets), was somewhat offset by the ever-increasing budget deficit and the recent downgrade of US debt by Moody’s. Nevertheless, bonds managed to post a positive month again and are quietly up just over 4% on the year.

Surprising no one, the Federal Reserve held interest rates steady during its regular June policy meeting. The central bank emphasized it remains in a “data-dependent” status which most investors translate into “wait and see.” The committee did note that low unemployment and a solid labor market points to broadly positive underlying conditions but also said that persistent inflation has contributed in a big way to the bank’s inactivity on rates. The bond market is currently pricing in two 25 basis point rate cuts for the back half of this year, likely starting no earlier than September. As a reminder, the Fed’s last rate cut was in December 2024.

In terms of economic releases, most of the June data showed a continuation of the themes that have played out in recent months: slowing but resilient GDP growth, a tight and robust labor market, and sticky but not terribly high inflation. The June nonfarm payroll report showed the creation of 139K jobs in May, which was above estimates but slightly below April’s reading. The Consumer Price Index, which is the most widely followed and quoted measure of inflation in the economy, increased modestly at 2.4% annualized, which was in line with expectations. All told – not a lot of surprises in the June data. Market participants will be paying close attention to President Trump’s tax and spending package, entitled the “One Big, Beautiful Bill,” which as of this writing is still being debated in both houses of Congress. All eyes will also be pinned to the calendar on July 9th, when the 90-day postponement of “reciprocal tariffs” is due to expire.

Looking forward to the second half of the year, markets will be grappling with tariff strain, ongoing conflict in the Middle East, and the usual slew of economic data. While it is possible (and probably likely, given recent history) that tariffs could be further pushed out beyond July 9th, uncertainty still persists, and we recall how violently the market reacted to tariffs just a few months ago. Meanwhile, despite the interest rate picture likely to stay unchanged during the July 29-30 meeting, the Fed remains focused on balancing its dual mandates of price stability and full employment.

Overall, we are still in a good position as we kick off the second half of the year. Market fundamentals remain sound, and the economy is relatively healthy. While there are near-term risks to be aware of (and prepared for), over the longer horizon, we hope to continue to experience economic growth and further market appreciation.

Thank you for riding alongside us during this wild first half. It has been one of the most interesting stretches in market history, and there has not been a dull moment. We appreciate your interest and support, and as always we stand ready to help as needed.

Sincerely,

Jason D. Edinger, CFA

Chief Investment Officer

Boston Wealth Strategies

This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Please contact your financial professional for more information specific to your situation.