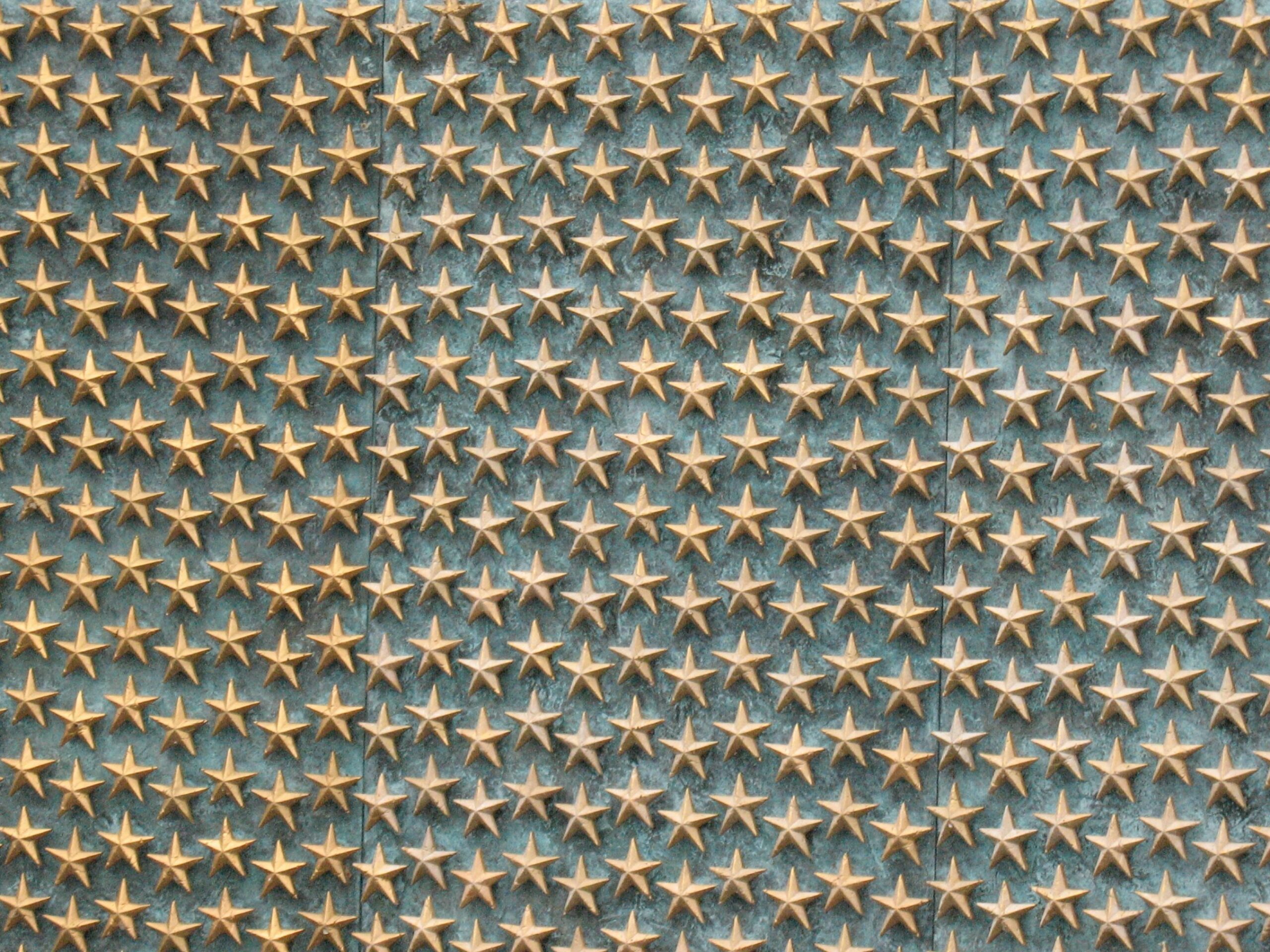

Four Stars Out Of Five

June 11, 2024

Posted by Jason Edinger on Tuesday, June 4, 2024

May was a solid month for equity markets, rebounding from a weak April to close in the black for the fourth month out of five this year. All the major benchmark indices closed the month higher than they began it, and the S&P500, Dow Jones, and NASDAQ all clipped new all-time highs. 10 of the 11 GICS sectors were positive, with only energy declining, owing mostly to falling oil prices. The tech-heavy NASDAQ lead the way with a 7% total return, while the old-school Dow lagged, delivering 2.6% of positive performance during the month. Overall, stocks reversed the prior month’s losses and move into June boasting an 80% monthly batting average so far in 2024. Not bad in my mind’s eye.

As has been the case in recent history, technology played the starlight role in May, turning in a 10% month to bring its year-to-date performance up to 17.3%. The sector owes much of its power to semiconductors, most notably the darling AI chipmaker Nvidia. The mega-cap tech giant delivered impressive quarterly results yet again, with both top-line revenue and bottom-line profit blowing even the most ambitious estimates out of the water. The company also guided towards even higher revenue and profit projections in the coming quarters. Accordingly, NVDA broke out to fresh record highs and was the single greatest contributor to S&P500 performance during the month. The mantra holds true: as goes tech, so goes the market.

If fundamentals drive market performance, as is often alleged, then investors have reason to remain optimistic. Q1 corporate earnings for S&P500 companies were solid, with 78% of companies beating earnings-per-share estimates. FactSet reports that the blended EPS growth rate for all members was 5.9%, far exceeding the 3.4% estimate. Communication services alone delivered an earnings growth rate of 34%. Some caution is warranted, however. Both revenue beats and EPS surprises were below long-term averages, and if one strips out the Magnificent 7 stocks, the blended growth rate for the S&P is -1.8%. Market breadth issues remain a concern, although tech and AI momentum continue to paper over the problem, at least for now.

In terms of economic releases, inflationary data were front of mind. Encouragingly, both CPI and PCE (two related but different measures of inflation) showed prices stabilizing in April, with each statistic rising just 0.3% monthly. The market quickly responded to the inflationary downtick, reigniting hopes for interest rate cuts later this year and kicking the “higher for longer” can down the road for at least one more month. While this bucking of the trend is undoubtedly a welcome development, overall inflation remains well above the Federal Reserve’s long-term 2% target rate, and during the month Jerome Powell himself suggested that the disinflation narrative would need more time to play out before the central bank can begin cutting rates.

Nonetheless, treasuries were mostly higher during the month, as a modest decline in yields resulting from the hope of disinflation contributed on the bond side as well. The bellwether 10YR treasury yield dropped during May, hovering around that critical 4.5% level from which it has not strayed much in the past 60 days. The treasury market remains in a holding pattern, awaiting the possibility of future interest rate cuts while digesting the ever-important inflation, jobs, and GDP data as they come. To note: the 10/2-year maturity curve remains inverted, as it has been for nearly 2 years now. Classically, this would be a leading indicator of a recession on the horizon, but we see no such signs as of this writing.

That seems like a fitting way to wrap up this month’s remarks. Memorial Day has come and gone, and as we near the midway point of the year, we wish each and all of you a happy early summer. Last month we found ourselves wishing for bright and sunny skies, and there is no doubt that May delivered both in spades. Let us hope this keeps up, in terms of both the weather and the markets. As ever, we thank you for your continued trust and support.