Pieces of the Pie: Asset Allocation 101

February 5, 2024

Asset allocation. An idiom as conventional to the investment management industry as “block and tackle” is to sports and “keep it simple” is to management consulting. And for good reason. Nearly always, asset allocation is the first crucial step taken in the portfolio construction process. As a result, its importance is broadly accepted and agreed upon – serving as the cornerstone of portfolio construction while simultaneously being the key determinant of overall risk and return. Important stuff, indeed.

At its core, asset allocation is a “big picture” exercise – it examines an investment portfolio in the aggregate to determine which asset classes should be included in the portfolio and in what amounts. What the proper mix of assets should be. Examples of common asset classes included in allocation portfolios include equities, fixed income, cash, and alternative investments. The type and amount of each respective asset class to include is driven primarily by the relationship between long-term capital market assumptions and the investor’s investment objectives, constraints, and overall financial situation. Dividing one’s investment exposure across a variety of complementary and opposing asset classes ensures that the portfolio is well-diversified and not unduly exposed to a single type of idiosyncratic asset class risk.

Rather than choosing just a single asset class in which to invest – say equities for example – asset allocation supporters argue for allocating pieces of the pie to several asset classes to achieve a higher risk-adjusted return over a longer period. The idea underpinning this theory is that, by combining various asset classes that are not perfectly correlated with one another – e.g. they move independently of each other – overall portfolio risk is reduced and therefore aggregate return, after adjusting for risk, is enhanced. A similar and often interchangeable term for this dynamic is diversification.

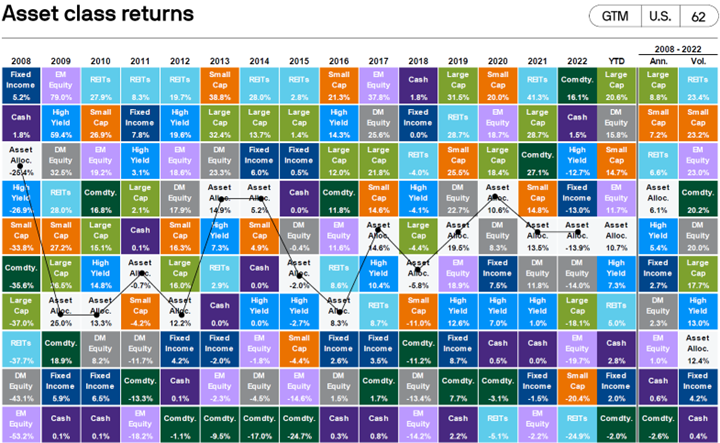

Over time, diversification works and has proven to be a sensible strategy. During the 15 years ending in December 2022, investors have been challenged by a multitude of unexpected and intimidating issues. From natural disasters to geopolitical conflicts to a global pandemic and two major market selloffs, the last 15 years have been a volatile and tumultuous ride for investors. While the individual returns for stocks, bonds and cash were decidedly mixed during that time period, an asset allocation portfolio of stocks, bonds and other assets held together returned approximately 6% per year, and around 150% on a cumulative basis (source: JPMorgan Asset Management).

The below graphic, brought up to date through July 31st, 2023, depicts a standard asset allocation portfolio in the white box connected with black lines. As one can see, the allocation portfolio typically lands somewhere in the middle of the pack relative to all other asset classes for any calendar year. Never the best, yet never the worst. Never the hottest, but never ice cold. This is by design, and the result over a long time horizon is a smoother, less volatile, and more comfortable ride for investors than they would realize by simply picking one or two asset classes to invest in isolation.

The returns for an asset allocation portfolio would naturally change depending on the mix of assets selected, the relative sizes of the assets within the portfolio, and the time period under measurement. At all times, a portfolio constructed with asset allocation as its foundation will have different parts of the portfolio performing differently during diverse underlying market environments. That is the entire point. Some asset classes will be “working” while others might not be. And while there is no perfect position or allocation that applies universally to all investors, and in some cases the asset allocation model may be out of favor relative to other philosophies, we can conclude that asset allocation is one of the most important elements of a sound investment plan.

It allows investors to prepare for a wide range of outcomes without having to lean into a crystal ball to predict the future or engage in the folly of market timing. By building a portfolio that encompasses a wide selection of securities and a broad range of asset classes and investment styles, the investor can help protect the portfolio from sudden changes in the financial markets. Additional benefits that can potentially be realized through this approach include reduced risk via lower volatility, opportunities for more consistent returns as the impact of poorly performing asset classes is lessened, and a greater focus on long-term goals as the need to constantly adjust positions or chase trends is minimized.

There is no doubt that asset allocation is a key factor in determining portfolio risk and return over time – in some cases accounting for 90% or more of portfolio performance. As there may be considerable value to be realized in focusing on the right mix of asset classes, rather than relying on stock picking or market timing as the primary driver of portfolio returns, it is worth returning to asset allocation principles early and often in the portfolio management process.

Asset allocation and diversification does not assure a profit or protect against loss in declining markets, and they cannot guarantee that any objective or goal will be achieved.