Nvidia Games

June 11, 2024

Posted by Jason Edinger on Sunday, March 3, 2024

The rally rolls on. Hard. Statistically, February is a challenging month, but this go ‘round the bulls defied the odds to end squarely in the green (and in record territory). The Dow, S&P500, and NASDAQ all made fresh all-time highs, while small caps (Russell 2000) made a new 52-week high. The Magnificent 7 stocks were mixed, as several of the darling tech companies failed to achieve new highs with the market and show signs of topping out. All S&P sectors were higher on the month, led by consumer discretionary, industrials and, of course, technology. All told, February did not suffer its usual sluggishness and as a result, 2024 is off to a very solid start.

The biggest story of the month was Nvidia, the poster child for both the tech sector and, more importantly, artificial intelligence. In its most recent quarterly update, Nvidia reported mind-boggling numbers, including a 265% increase in annual revenue. CEO Jensen Huang guided to even stronger projections for 2025 and 2026, also declaring that artificial intelligence had “hit a tipping point” with surging demand “across companies, industries, and nations.” Accordingly, Nvidia was rewarded with a $277B increase in market cap that day, an historical record for any US-listed company. The stock was up 28% on the month and helped fuel the broader rally across the major indices. Investors remain spellbound by the potential of artificial intelligence, and no company has done more to capture their collective imagination than Nvidia.

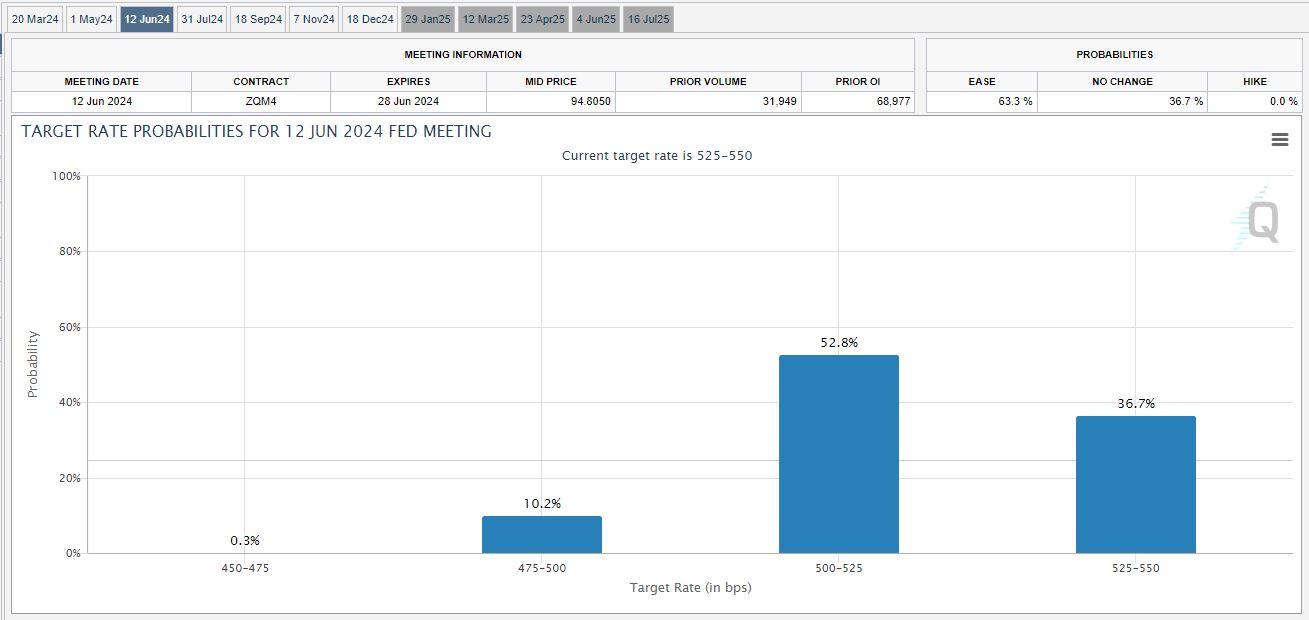

The other big story in February was the hawkish shift in rate cut expectations from March to June. The messaging out of the Federal Reserve has remained remarkably consistent in recent months. The central bank remains “data dependent” and wants to see more evidence of inflation cooling before it cuts rates. It also signaled that it would begin discussions of quantitative easing at its next meeting, effectively taking a March rate cut off the table. As such, Fed fund futures are now pricing in a 67% chance of a cut in June and just three 25bp cuts this year (see chart courtesy of CME Group).

From an economic standpoint, the data continue to come in mixed. January was the third consecutive month where the unemployment rate did not budge from its 3.7% mark, and the 24th consecutive month below 4%. The employment number was much stronger than expected, with job creation clocking in at 353K vs. 185K expected. This was the highest level of job creation in over a year. By contrast, inflationary data were less rosy, as the year-over-year headline number came in above expectations at 3.1%. As has been the case in recent months, shelter and food at home were the biggest drivers of price increases. This report, while showing year-over-year easing in inflationary pressures, was still hot enough for the Fed to maintain its hawkish timeline as to when rate cuts will begin.

A few words must be said about cryptocurrency and bitcoin. The world’s most valuable cryptocurrency ended February with an astronomical gain of 43%, its best monthly achievement in over three years. The rally was supported by the SEC’s January approval of 11 new spot bitcoin ETFs, which have garnered substantial inflows (tens of billions) and have sparked renewed enthusiasm (and speculation) in cryptocurrency. Bitcoin is now up seven months in a row, and the wave of optimism has spilled over into crypto-centric companies such as Microstrategy and Coinbase. Resembling what we are seeing in the artificial intelligence space, it is obvious that speculation is back in the cryptocurrency markets.

Looking ahead, we have Fed Chair Powell testifying in Washington on March 6th and 7th. His comments will likely impact how bond and equity investors position themselves for the near and intermediate terms. In terms of economic releases, we have the usual slate of nonfarm payrolls (8th), inflation (12th) and FOMC rate decision (20th).

As ever, we thank you for your continued trust and confidence. Please reach out with any questions or concerns.

*This article is intended strictly for educational purposes and is not a recommendation for or against cryptocurrency.